Savings Groups Change Lives in Benin

Each Wednesday afternoon, a group of 30 women and men come together under the shade of a large tree in Bouyerou, a small village in northern Benin’s Parakou region. Seated upon a circle of wooden benches, they chat quietly among themselves as they wait for the meeting of their savings group to be called to order.

Members of the Antissoua savings group come together for their weekly meeting in northern Benin.

Photo by Jennifer Lazuta/CRS

They are following a Catholic Relief Services methodology called Savings and Internal Lending Communities, or SILC. They meet four times a month to contribute to a reserve fund that can be loaned out to members and used to help them grow their businesses, households or agricultural activities. This particular group, called Antissoua, was set up as part of the BeninCajù project facilitating access to financial services for cashew producers.

After the group’s president takes attendance, three women, each of whom guards one of the keys that unlocks the safe where the money is kept, approach the small rectangular metal box. With a quick turn of their wrists, the three locks fall to the ground and the lid of the box is lifted. The group’s treasurer counts the money inside, for all to see, and the secretary verifies that the amount matches that from the previous week.

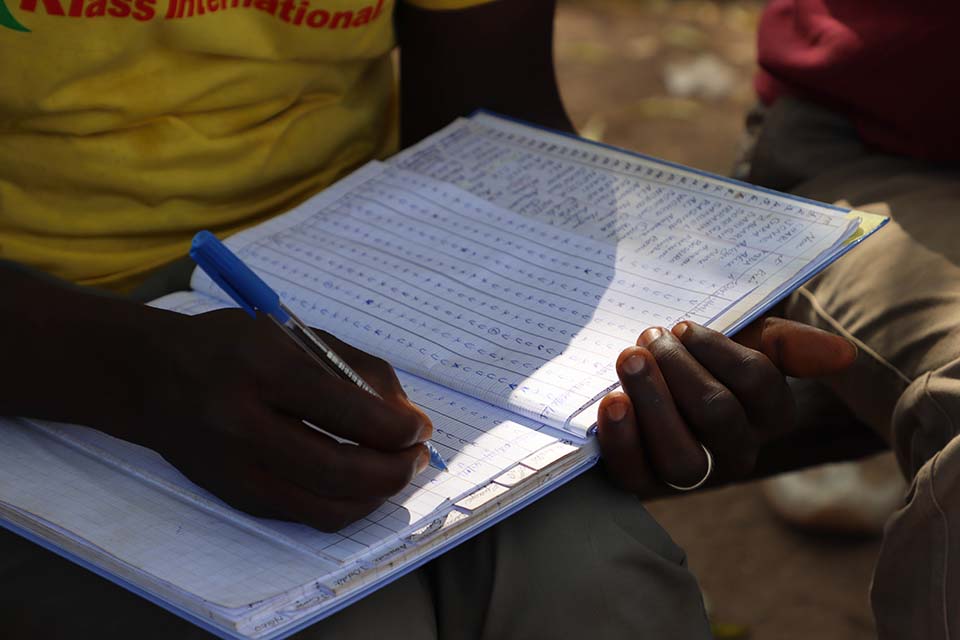

Then, one by one, each member is called upon to approach the box and contribute to the savings reserve. The minimum contribution is $1.70, but those who want to give more can—up to $8.50 per week. The amount of each contribution is meticulously recorded in a lined notebook and a running total is kept as the treasurer punches keys on a small calculator.

Gani Soregui Orou, the secretary of the Antissoua savings group in Bouyerou, in northern Benin, records the weekly contributions of each member in the group’s notebook.

Photo by Jennifer Lazuta/CRS

The group’s president then asks if anyone has experienced an unexpected life event, such as a family death or illness, that requires an emergency loan or a donation from the solidarity fund. No one raises their hand this week. Then a few members who had taken out loans in previous weeks come forward to pay them back. Finally, anyone wanting to take out a new loan is invited to come forward to state the purpose and amount of the proposed loan.

This group, which was created back in 2016, is now on its sixth cycle of loans. To date, the group has raised and loaned out more than $2,100. This is something every group member will tell you has changed their life.

Among them is Bona Bagoudou, a mother of nine children and proud grandmother of “a countless number” of grandchildren. She is among the founding members of the Antissoua group. Bona first joined after CRS field agents came into the community and explained how the SILC methodology works.

“I was quite interested in the model they described, so I put my name on the list,” Bona recalls. “I understood it was a good opportunity to grow my business, especially after the death of my husband, which left me struggling to provide for my family,” she says.

Unable to secure a loan from a bank, and not able to afford the high-interest rates even if she could, Bona used both large and small loans from the group—ranging from as little as $30 up to around $250—to slowly build up both her business and home. With loans, she was able to save money buying supplies in bulk for her business producing and selling a local beverage made from corn. She was also able to make improvements to both her house and shop, such as adding metal doors for extra security, a tin roof to protect from the rain and cement to cover the walls previously made from mud bricks that needed to be replaced every year.

With profits from her business, Bona eventually planted crops on family lands, using the harvest to feed her family and selling what was left for extra income.

As Bona’s family continues to grow, she says she would like to add a few more rooms to her home so that everyone can live together comfortably.

“This group really changed my life,” Bona says smiling. “Before, no matter how hard I worked, it was hard to get ahead—sometimes even hard to keep up. I couldn’t achieve anything remarkable. But thanks to the small loans, I have been able to increase my capital and grow my business and home. My heart is full.”

Bona Bagoudou is among the founding members of the Antissoua savings group. Thanks to small loans, she has expanded her home and business.

Photo by Jennifer Lazuta/CRS

Savings and Internal Lending Communities (SILC) is a micro-finance approach implemented by CRS, which provides a safe place to save, borrow, and increase income for communities and individuals with little or no access to formal financial services. SILC members own and manage their groups, thereby increasing social cohesion, stabilizing household incomes, and providing additional sources of revenue. SILC members count on the revenue for health insurance premiums, agricultural inputs, and educational supplies. Certified field agents are selected from communities and sustain SILC groups on a fee-for-service basis, ensuring sustainability beyond the end of projects. At the end of 2021, there were more than 94,000 SILC members (75% of whom are women), across 3,716 groups in Benin, with $1.6 million in savings.